The 2025 real estate market presents both opportunities and challenges for mid-market commercial real estate (CRE) investors. With elevated interest rates and continuing strict lending standards, the financial landscape has shifted significantly from prior cycles. Successfully navigating these changes requires a strategic approach to debt solutions—one that balances risk, leverages alternative capital sources, and aligns with long-term investment goals to ensure a successful commercial real estate transaction. This article dives into key strategies to optimize debt in today’s financial climate. You’ll discover actionable insights to refine your borrowing approach, learn from real-world examples, and gain a deeper understanding of how to maximize opportunities despite economic headwinds.

The Impact of Elevated Interest Rates

Interest rates have risen steadily over the past few years, creating ripple effects across the CRE landscape. For mid-market investors, these changes directly influence borrowing costs, returns, and acquisition strategies.

Increased Cost of Borrowing

Higher interest rates have made debt financing more expensive, squeezing margins and decreasing purchasing power.

- Debt Service Coverage Ratios (DSCR) requirements are harder to meet due to increased monthly payment obligations.

- Discount rates applied to property valuations have also risen, leading to downward pressure on asset prices.

- Elevated interest rates have also had an effect on return requirements for equity investors; as rates have risen, so too have their return thresholds.

Effect on Property Valuations

Valuation models that heavily depend on yields, such as cap rate-based or discounted cash flow models, have adjusted to reflect the costlier financing environment.

- Result: Buyers are approaching deals more cautiously, while sellers face challenges achieving desired pricing.

Strategic Investment Shifts

The shift has prompted investors to rethink their strategies. Assets such as stabilized multifamily properties and industrial properties—valued for their predictable income—continue to perform well. Conversely, properties heavily reliant on speculative appreciation face heightened scrutiny.

Key Insight

Flexibility and prudence are essential for today’s investors. Evaluating deals with an emphasis on long-term cash flow instead of short-term gains can mitigate risks tied to high borrowing rates.

Navigating Stricter Lending Standards

Traditional lenders, particularly banks, are continuing to apply conservative underwriting policies. Though pricing spreads have become more competitive, the equity requirement remains high by historic standards. This trend has significantly altered how mid-market investors secure financing.

Bank Pullback in Lending

Lenders are now imposing:

- Lower Loan-to-Value (LTV) ratios, with many transactions capped at 60-65%.

- Higher DSCR thresholds, often requiring ratios of 1.30 or more.

- Increased diligence on property performance and borrower track records.

These tighter constraints create hurdles for investors seeking conventional loans, especially for value-add or transitional properties.

Rise of Alternative Capital Sources

Private credit lenders—including debt funds, family offices, and mezzanine lenders—are stepping in to fill the gap. These entities typically offer higher LTVs and more flexible terms but at a premium cost.

- Key Advantage: Faster transaction timelines and creative structuring options.

- Potential Risk: Higher interest costs and shorter durations can strain cash flow if improperly managed.

What This Means for Investors

Understanding how to work with both traditional and alternative lenders is critical for maintaining access to capital. Partnering with brokers who have robust networks can simplify this process and reduce turnaround times.

Strategic Responses for 2025

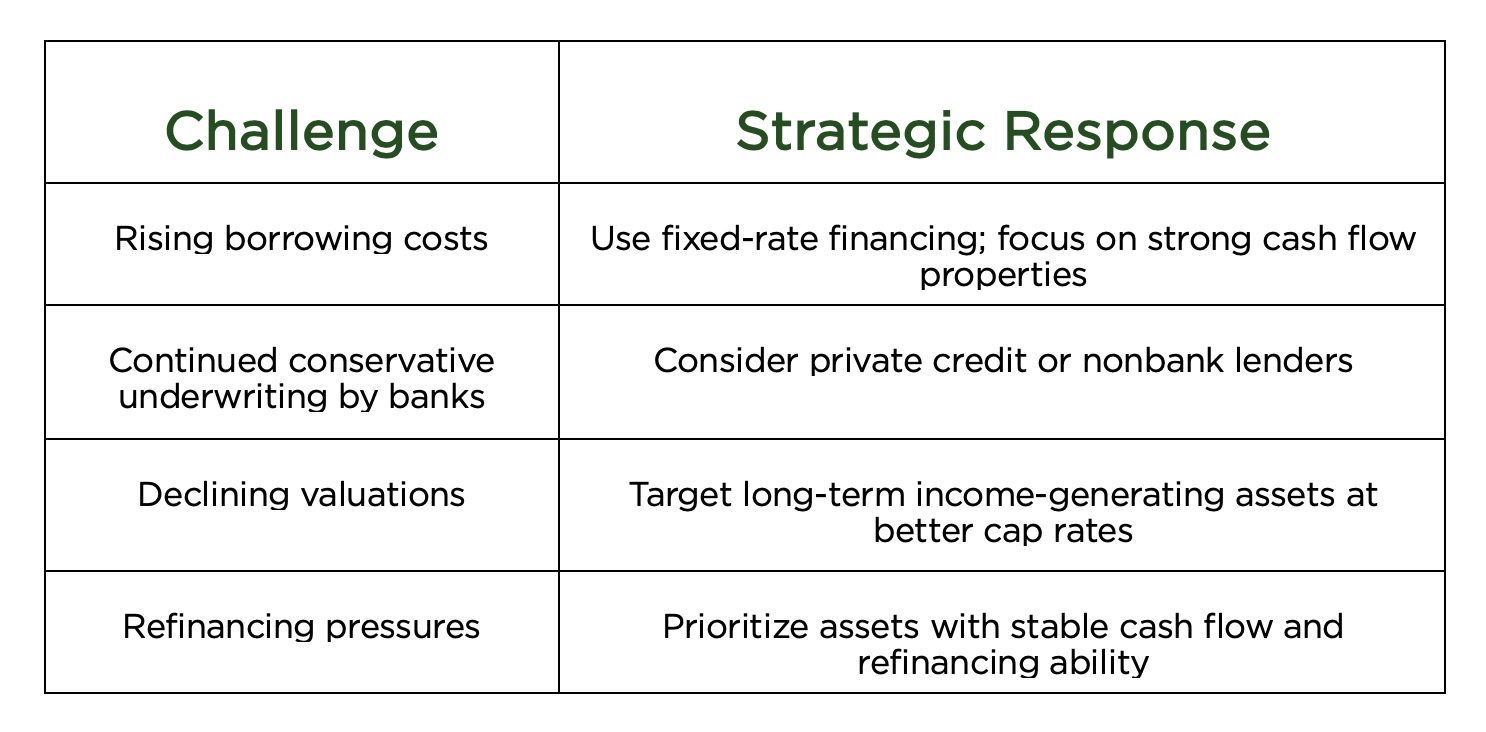

With these challenges, mid-market investors must operate with sharper focus and adopt creative solutions to maintain positive momentum. Below are strategic considerations to optimize your debt in the year ahead.

1. Prioritize Cash-Flow-Strong Assets

Target properties with stable, predictable income streams to insulate your portfolio from financing volatility.

- If renovation and subsequent rent bumbs are part of your strategy, that’s fine, but the plan must be very specific and supported by current submarket comp data.

- Sectors like multifamily and industrial are particularly attractive, given consistent demand and slower cyclical downturns.

- High-occupancy or long-term lease structures ensure greater predictability in servicing debt.

2. Lock in Fixed Rates

Securing fixed-rate debt provides peace of mind and shields against future rate hikes. While fixed-rate loans may cost more initially, they offer stability and long-term cost savings.

- Anticipate further unpredictability in monetary policy decisions through 2025.

- Consider blended fixed/hybrid loan structures for enhanced flexibility.

3. Explore Alternative Capital Solutions

Diversify your debt sources by exploring seller financing, mezzanine loans, or preferred equity deals. Each option meets unique needs:

- Seller Financing: Lower barriers for deal closure while minimizing equity hurdles.

- Mezzanine Loans: Ideal for bridging the equity gap in high-potential projects.

- Private Credit: Provides short-term liquidity that traditional banks may not.

4.Prepare for Refinancing Challenges

A wave of loans maturing between 2025 and 2026 increases refinancing risks. Elevated rates and lower valuations mean borrowers must:

- Reposition assets to improve operational performance and NOI.

- Maintain a DSCR above lender thresholds by limiting leverage where necessary.

- Engage brokers to secure financing optimized for current conditions.

5. Monitor Your Portfolio Metrics Closely

With stricter lending conditions, keeping a pulse on key performance indicators, such as LTV ratios and NOI trends, can ensure you remain eligible for refinancing or supplemental loans.

Summary Table

Key Takeaways

- Interest rates: Rising rates demand a focus on predictability and cash flow to balance portfolio risks.

- Alternative lenders: Shorter transaction timelines and creative terms mitigate traditional bank constraints.

- Strategic debt use: Locking fixed rates and diversifying lender relationships ensure long-term resilience.

Positioning your portfolio for success in 2025 hinges on understanding market headwinds, emphasizing cash flow over speculative returns, and working with brokers who provide diverse capital access.

FAQ About Strategic Debt Solutions

What are cash-flow-strong assets?

These are properties with steady and predictable income streams, such as high-occupancy multifamily units or industrial properties.

How can I secure better loan terms in 2025?

Focus on maintaining a low LTV ratio, improving NOI, and partnering with brokers to access diverse lender relationships.

When are fixed-rate loans more advantageous?

Fixed-rate loans are ideal when interest volatility is expected, as they protect you from rising borrowing costs.

What are the risks of private credit lenders?

Private credit loans come with higher interest rates and shorter durations, requiring optimized asset performance to mitigate risks.

How do supplemental loans work?

These are added loans obtained after closing the original loan, offering additional capital without refinancing the entire debt structure.

Navigating today’s real estate finance environment requires expertise and the right partnerships. At Essex Capital Markets, we specialize in tailored solutions to help you succeed. Contact our team today using the form below, and gain access to strategic advice and a reliable network to enhance your next deal.