Recourse vs. Non-Recourse Loans: Why It Matters in Commercial Real Estate

In the landscape of commercial real estate finance, the structure of a loan agreement can be as critical as the interest rate. For sophisticated investors and developers, understanding the nuances between recourse vs. non-recourse financing is fundamental to strategic risk management and portfolio optimization. The choice between these two structures dictates the lender’s reach in the event of a default, profoundly impacting the borrower’s personal and business financial exposure.

This decision is not merely a line item in a term sheet; it’s a strategic choice that aligns with your investment horizon, risk tolerance, and the specific dynamics of the asset. This article will dissect the core principles of recourse and non-recourse commercial loans, explore their advantages and disadvantages, and provide the insights you need to make an informed decision for your next project. We will also illustrate how a skilled capital advisor can help navigate this complex terrain.

Defining the Terms: Recourse vs. Non-Recourse

At its core, the distinction between recourse and non-recourse loans lies in what assets a lender can pursue if a borrower defaults. Think of it as the lender’s safety net. How extensive is that net, and does it cover just the property itself or extend to your other assets?

What is a Recourse Loan in Real Estate?

A recourse loan gives the lender the right to go after a borrower’s other assets if the sale of the collateral property is not enough to cover the outstanding loan balance. The borrower, and any guarantors, are personally liable for the current debt level. If the property’s value plummets and a foreclosure sale results in a shortfall, the lender can seek a deficiency judgment to seize other assets—such as other properties, bank accounts, or investments—to satisfy the remaining debt.

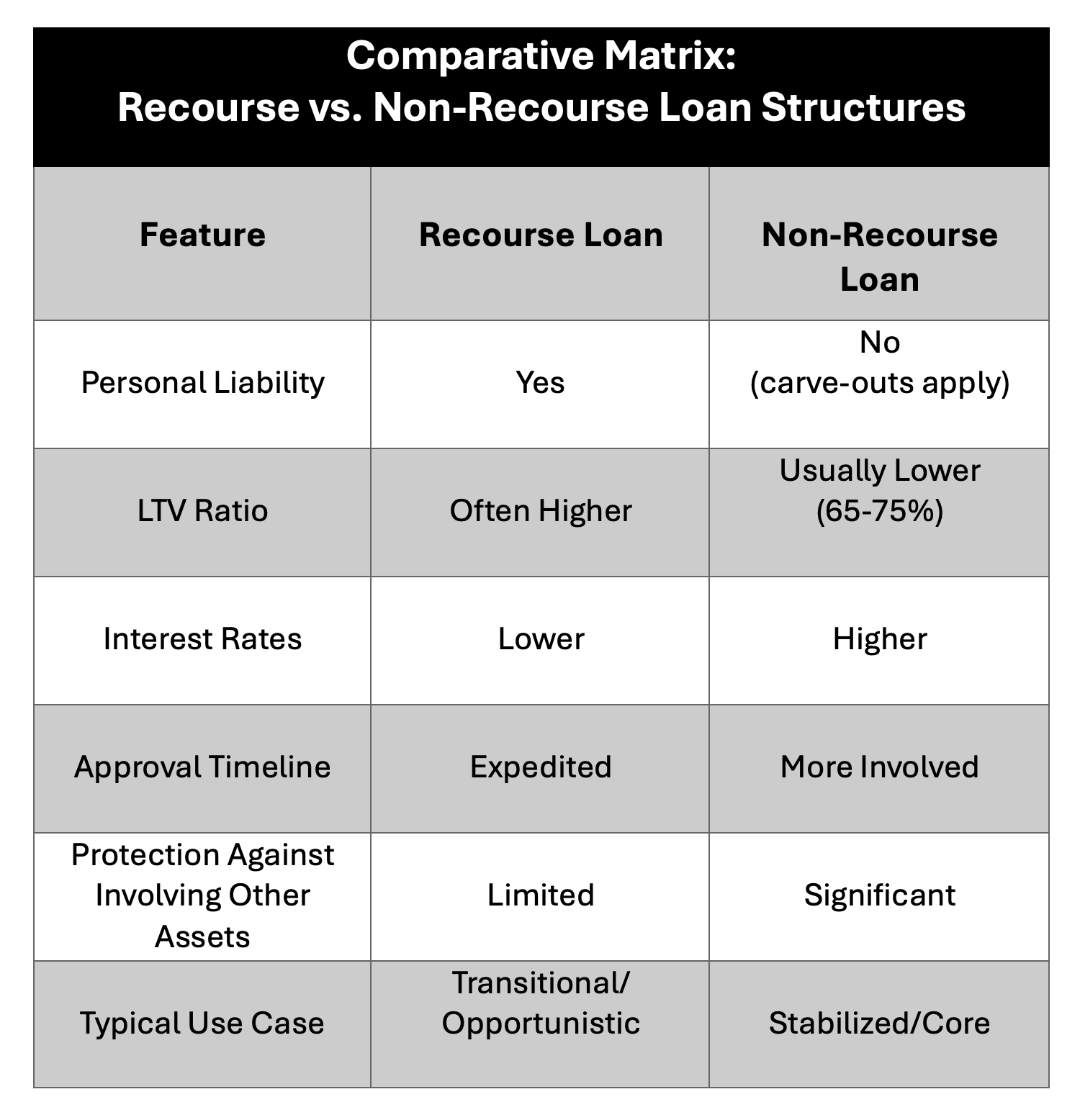

This structure significantly reduces the lender’s risk, making them more willing to offer financing, often with more favorable terms like lower interest rates or higher loan-to-value (LTV) ratios.

What is a Non-Recourse Loan in Real Estate?

A non-recourse loan, by contrast, limits the lender’s remedy to the collateralized asset only. If the borrower defaults, the lender can seize and sell the property, but they cannot pursue the borrower’s other personal or business assets to cover any shortfall. The property itself is the sole source of repayment.

This structure shifts a substantial portion of the risk from the borrower to the lender. As a result, non-recourse loans are typically reserved for high-quality, stabilized assets with strong cash flow and experienced sponsors. Lenders mitigate their increased risk by charging higher interest rates, offering lower LTVs, and requiring more stringent underwriting.

It is crucial to note that most non-recourse loans include what’s known as a “carve-out” guarantee. These provisions convert the loan to full recourse if the borrower engages in fraudulent activities like misrepresenting financials, committing waste on the property, or declaring bankruptcy in bad faith. These activities are “carved out” from the non-recourse aspect of the transaction. The theory behind the carve-out is that, because these fraudulent actions are within the borrower’s control, the transaction is still non-recourse

Comparing Recourse and Non-Recourse Loans: Which Is Right for You?

The choice between these loan types involves a classic risk-reward analysis. What is more valuable for your specific deal: personal asset protection or more aggressive financing terms?

Understanding Recourse Loans: Key Benefits and Risks

Advantages:

- Competitive Terms: Typically offers lower interest rates and higher leverage compared to non-recourse options.

- Broader Lender Access: Many banks and credit unions only offer recourse or partial recourse loans, so this structure opens a wider range of financing options.

- Flexibility: Recourse loans often come with simpler documentation, faster closing timelines, and more willingness from lenders to work with borrowers on structure or covenants.

- Ideal for Certain Projects: Well-suited for transitional assets, construction projects, or situations where the borrower’s strong balance sheet can be used to secure better pricing.

Disadvantages:

- Unlimited Personal Liability: Recourse loans make you personally responsible for repayment beyond the property’s collateral. In the event of a default, lenders can pursue your personal assets to cover the remaining balance.

- Impact on Balance Sheet: Personal guarantees show up as contingent liabilities and can sometimes limit your ability to borrow for other projects until the loan is repaid or released.

When does it make sense? A recourse loan is most commonly used by borrowers seeking to maximize leverage and secure the most competitive terms. It is often the preferred structure for transitional assets, construction projects, or for sponsors with strong balance sheets looking to execute quickly and efficiently.

Understanding Non-Recourse Loans: Key Benefits and Risks

Advantages:

- Personal Asset Protection: Your personal and other business assets are shielded from the lender in the event of a default on a specific property, allowing you to compartmentalize risk.

- Partnership Friendly: Often preferred in partnerships because it limits liability to the asset itself and avoids complicated personal guarantee negotiations among partners.

- Portfolio Scalability: Isolating risk to individual assets can make it easier to grow a portfolio without one deal affecting the others.

Disadvantages:

- Stricter Underwriting: Lenders scrutinize the property’s cash flow, tenant quality, and market stability much more intensely. Only high-quality, stabilized assets typically qualify.

- Narrower Lender Pool: Fewer banks and credit unions offer non-recourse financing, which can limit available options and negotiating leverage.

- Less Favorable Terms: To compensate for their increased risk, lenders usually offer lower LTVs (typically 65-75%) and charge higher interest rates or fees.

When does it make sense? Non-recourse financing is ideal for stable, income-producing properties with strong operating histories, such as a fully leased Class A office building or a multifamily complex in a prime location. It is the preferred structure for investors prioritizing risk mitigation and asset protection.

Real-World Example: Recourse vs. Non-Recourse in Practice

Imagine two investors acquiring similar multifamily properties.

Investor A chooses a recourse loan to secure a high LTV of 80% and a very competitive interest rate. This allows them to put less cash down and maximize their initial return on equity. However, they have personally guaranteed the loan. If a local employer shuts down, causing vacancies to spike and the property value to fall, they are personally responsible for any deficiency after a foreclosure sale. Their other properties and personal savings are at risk.

Investor B opts for a non-recourse loan. They receive a lower LTV of 65% and a slightly higher interest rate. While their initial cash-on-cash return is lower, their risk is contained entirely within the asset. If the same economic downturn occurs, they may lose the property and their equity in it, but the lender cannot touch their other investments.

Which investor made the better choice? The answer depends entirely on their risk tolerance, portfolio strategy, and long-term goals. Investor A prioritized leverage and returns, accepting personal risk. Investor B prioritized wealth preservation, accepting a lower return for greater security.

How Essex Capital Markets Helps You Structure the Right CRE Financing

Choosing between recourse and non-recourse financing is a deliberate decision that requires a deep understanding of market conditions, lender appetites, and your own financial position. This is where an expert capital advisory firm like Essex Capital Markets adds immense value.

Our role is to go beyond simply presenting term sheets. We provide the data-backed insights and structuring expertise necessary to align the financing with your specific objectives.

- Access to Diverse Capital: We maintain relationships with a broad spectrum of lenders, from traditional banks and credit unions that favor recourse loans to life insurance companies, CMBS lenders, and agencies that specialize in non-recourse financing. This allows us to find the right capital partner for any deal.

- Custom Financing Solutions: We analyze your project’s unique characteristics and your financial profile to determine the optimal loan structure. We can negotiate terms, structure carve-outs, and ensure the financing solution is tailored to your needs.

- Streamlined Execution: Our expertise allows us to anticipate lender requirements and manage the underwriting process efficiently, ensuring swift decision-making and a timely closing.

Process Overview: Navigating Commercial Loan Structuring in Five Phases

A disciplined, analytical approach is essential to secure optimal terms in today’s financial environment. Consider the following progression:

- Define Objectives and Assess Risk Appetite: Articulate short- and long-term portfolio goals, evaluate the risk tolerance of your organization, and analyze asset-specific factors.

- Survey the Lending Market: Compare offerings from commercial banks (typically recourse) and institutional or CMBS lenders (non-recourse experts).

- Scrutinize Loan Terms and Carve-Out Provisions: Meticulously review all terms and overall loan structure, such as covenants, guarantees, recourse language, interest rates, and exit costs.

- Consult Specialized Advisors: Engage with a commercial finance advisor, such as Essex Capital Markets, to tailor loan structuring, mitigate exposures, and negotiate on your behalf.

- Close, Monitor, and Optimize: Complete due diligence, document the transaction, and implement monitoring systems. Reassess financing strategies as market or portfolio conditions evolve.

Conclusion: Making an Informed Choice in CRE Capital Structuring

Choosing between recourse and non-recourse financing requires more than a cursory review of loan terms, it demands a holistic, data-driven approach aligned with your investment strategy. The right capital structure is foundational to sustainable growth, smart risk management, and long-term portfolio performance.

At Essex Capital Markets, we help clients navigate these complexities with rigorous market analysis, deep lender relationships, and tailored financing solutions. Explore our commercial finance insights or subscribe for regular updates. Strategic decisions start here – let us guide your next opportunity.

Recourse vs. Non-Recourse Loans: Frequently Asked Questions

What is the main difference between a recourse and a non-recourse loan?

The key difference lies in borrower liability. With a recourse loan, the lender can pursue the borrower’s personal or business assets beyond the property if there’s a loan default. With a non-recourse loan, the lender’s recovery is limited strictly to the collateralized property, unless carve-outs are triggered.

When should I use a recourse loan in commercial real estate?

Recourse loans are often used for value-add projects, construction loans, or deals with higher risk profiles. Borrowers with strong financials may prefer recourse debt to access higher leverage, better rates, or more flexible terms.

What are “carve-outs” in non-recourse loans?

“Carve-outs” are exceptions in non-recourse loan agreements that make the loan fully recourse if the borrower commits fraud, misrepresentation, voluntary bankruptcy, or other prohibited acts. These protect the lender from borrower misconduct.

Are interest rates lower for recourse or non-recourse loans?

Recourse loans typically offer lower interest rates because the lender assumes less risk. Non-recourse loans often come with higher rates and lower loan-to-value (LTV) ratios due to the lender’s limited recovery options.

Can I get non-recourse financing for a value-add or development deal?

It’s rare. Most non-recourse lenders focus on stabilized, income-producing assets with strong cash flow. Value-add, transitional, or ground-up developments generally require recourse financing or heavy sponsor guarantees.

Do non-recourse loans protect me in a market downturn?

Yes — one of the biggest advantages of non-recourse loans is asset-level liability. If a property underperforms, your personal assets and other holdings are not at risk, provided you haven’t violated any loan provisions.

What type of lender offers non-recourse commercial loans?

CMBS lenders, life insurance companies, and some private debt funds are common sources of non-recourse loans. Banks typically prefer recourse structures, especially for smaller or riskier deals.

How do I choose the right structure for my investment strategy?

The best loan structure depends on your risk tolerance, deal profile, partnership structure, and long-term portfolio goals. Working with a capital advisor like Essex Capital Markets helps ensure you secure a loan that aligns with your overall investment strategy.

To speak with our Capital Markets team about buying commercial real estate refinancing, please fill out the form below.